We help inspired entrepreneurs and enterprising management teams to bring their dreams and goals to life. We started working at our kitchen table in 2007. Now, we have grown into a strong collective of professionals with solid financial and operational business experience. We help companies become successful on a scale much bigger than they ever imagined.

We focus on established, medium-sized and profitable companies in the Netherlands, Belgium, Denmark and Germany with clear growth opportunities, such as organic growth, international expansion and buy-and-build. We like to team up with unique entrepreneurs and enterprising managers to jointly realize ambitious growth plans. With our companies, we seek an active approach that is based on true entrepreneurship, growth acceleration and transformation, and is spurred by the human factor and sustainability.

With over 25 (international) transactions every year, we have a strong track record in market consolidations and operational transformations. Our transactions typically involve founding entrepreneurs or family businesses that are looking for a partner to help navigate their next phase of growth.

Holmris B8

HOLMRIS B8 is leading Nordic B2B sales & design house developing, selling, and realizing interior design solutions for public and private spaces.

SPC

SPC is a leading group focusing on coating and maintenance services for large metal structures in the industry, energy, and infrastructure sector.

Erhvervs Webdesign

Erhvervs Webdesign is a leading Danish digital marketing agency with a focus on small-sized companies.

Fruit Op Je Werk

Fruit Op Je Werk is a supplier of fresh fruit boxes to organizations in the Netherlands.

Ciphix

Ciphix is a hyperautomation specialist, which helps companies automate and optimize processes.

Amsterdam Data Collective

Amsterdam Data Collective assists organisations to become data driven through data strategy, data engineering, data science, and data visualization.

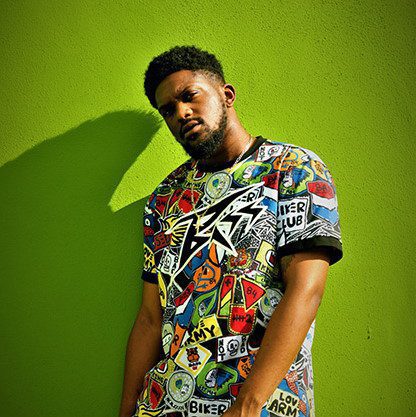

People

We believe in the strength of people and collaboration. Our people are all specialists with a great deal of ambition and knowledge, years of experience, and a highly enterprising attitude. The team is diverse and has developed a healthy and thriving team spirit, in which everyone is valued. That is the way for us to achieve durable success.

Sustainability

At Mentha, we care about a sustainable, safe, healthy and fair environment. We make our companies future-proof by integrating sustainability into the ambitions and growth plans. It makes companies stronger and contributes to growth and profit. We are therefore selective in working with companies, entrepreneurs and management teams who share our vision on the importance of sustainable business.

We aim to make responsible decisions. From strict supplier selection to energy-saving measures, smart mobility, full carbon offset, the separation of waste streams and continuous investment in a diverse, healthy and happy team.

In addition, we actively support non-profit initiatives which our team is passionate about. We spend 7.5% of annual profits, and devote time, knowledge and network, to such partners.

Mentha and SPC start partnership to accelerate international growth strategy

Mentha has entered into an agreement with SPC Group to accelerate the company’s (international) growth. SPC specializes in protective coatings within the metal industry, serving a diverse and respected clientele in various sectors including energy, infrastructure, and industry. The Belgian company aims for faster international growth, both organically and through acquisitions, with the Netherlands as starting point. Besides international expansion, further expansion in Belgium remains on the agenda.

Read more…

Our companies